MIB is engaged in Faster Payments. We are proud in being named a participating organization for the Federal Reserve Bank FedNow Pilot program. We are collaborating with others across the country to evaluate emerging faster payment solutions that are cost effective, easy to use and structured to serve the specific needs of your individual bank and the market(s) you serve. As such, before signing up with a vendor for a faster payment product, please contact Lyndsay York.

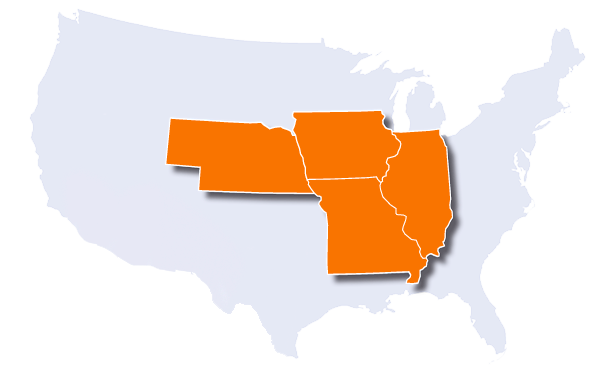

We’re a bankers’ bank dedicated to providing exceptional correspondent banking products, services and solutions for community banks, while increasing value to our investor institutions.

We’re a bankers’ bank dedicated to providing exceptional correspondent banking products, services and solutions for community banks, while increasing value to our investor institutions.